Section 8 Investing - The Complete Guide

Section 8 housing can be a lucrative venture for real estate investors. Inflation, stagnant wages, and rent increases across the country are leading more low-income families to look for affordable housing.

For rental property owners, relatively low acquisition and renovation costs, high demand, and guaranteed monthly income from the U.S. government make Section 8 investing a high cash-flow opportunity.

However, before adding Section 8 housing to your real estate portfolio, it’s important to understand the risks as well as the rewards, and how to maximize your investment.

Karim Naoum of Recession Proof Blueprint has used his experience working for the Section 8 housing authority to acquire over 100 properties that net tens of thousands of dollars per month. He’s learned how to navigate off-market sales, appeal to motivated sellers, and attract quality tenants – while ignoring a lot of the conventional advice that’s circulating online.

In this comprehensive guide, we will walk you through the essentials of Section 8 investing, from understanding the basics of the U.S. Department of Housing and Urban Development's (HUD) Housing Choice Voucher Program to navigating the specific challenges and opportunities that come with this investment strategy.

You will learn about the benefits of steady government-backed rental income, the criteria for eligible properties, the tenant screening process, and the compliance requirements to ensure your investments are both profitable and in line with federal regulations.

Let’s get started.

Section 8 Investing: Voucher-Based vs Project-Based Explained

Approximately 3 million households live in Section 8 properties. Managed by HUD, the Section 8 Program has been providing financial assistance to individuals and families since it launched in 1974. Since then, it has created a path for countless people to find affordable, safe housing.

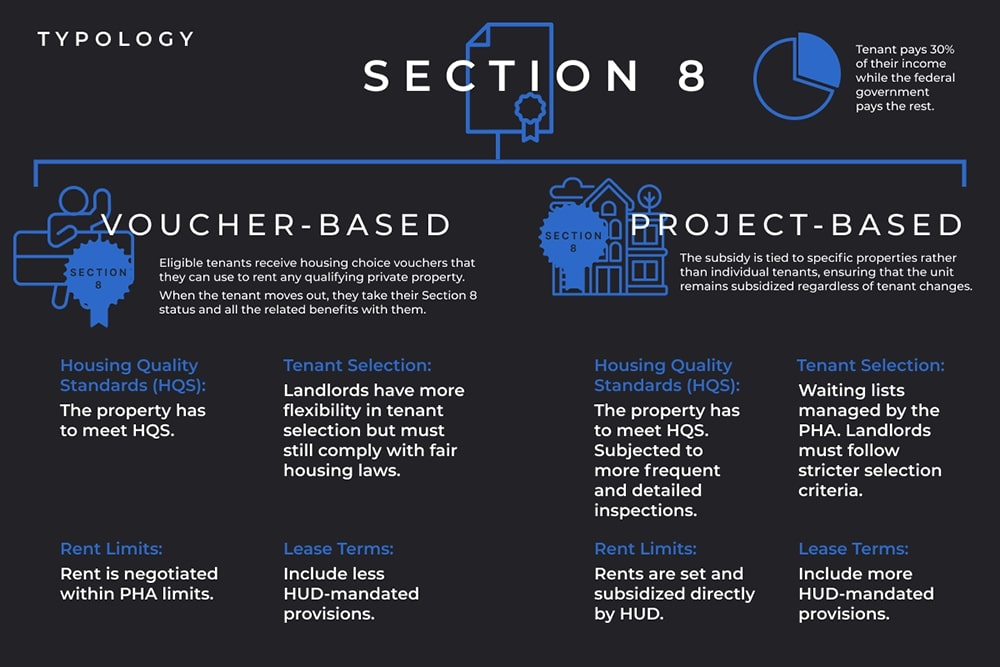

When investing in Section 8 housing, it's important to understand the differences between voucher-based and project-based programs.

Voucher-Based Section 8 Investing

In the voucher-based system, eligible tenants receive housing choice vouchers that they can use to rent any qualifying private property. Of the 4.8 million American households receiving some form of housing assistance from the federal government, approximately 2.1 million have Section 8 vouchers.

Investors in this type of Section 8 housing benefit from a reliable tenant base, as the government subsidizes a portion of the rent directly to the landlord. Generally, the tenant is required to pay rent equal to 30% of their income while the federal government pays the rest.

This can ensure steady rental income and reduce vacancy risks. Additionally, landlords retain flexibility in tenant selection within the program's guidelines.

However, when the tenant moves out, they take their Section 8 status and all the related benefits with them. The apartment reverts to being a regular rental unit unless another Section 8 voucher holder rents it.

Project-Based Section 8 Investing

In the project-based system, the subsidy is tied to specific properties rather than individual tenants, ensuring that the unit remains subsidized regardless of tenant changes.

For example, rental assistance would be associated with specific multifamily residential buildings. Tenants who live in these units benefit from the subsidy as long as they remain in the unit.

While investors in project-based Section 8 properties have the assurance of long-term rental income from the government, they must adhere to stricter property maintenance and management standards as mandated by the program.

Standards for Section 8 Properties – Project-Based vs. Voucher-Based

Here’s how the standards for landlords in project-based Section 8 properties differ from those in voucher-based situations, primarily in responsibility and oversight:

Housing Quality Standards (HQS): Both must meet HQS, but project-based properties are subject to more frequent and detailed inspections by HUD or the local Public Housing Authority (PHA).

Rent Limits: In project-based housing, rents are set and subsidized directly by HUD, whereas in voucher-based housing, the tenant finds housing, and the rent is negotiated within PHA limits.

Tenant Selection: Project-based landlords often have waiting lists managed by the PHA and must follow stricter selection criteria. Voucher-based landlords have more flexibility in tenant selection but must still comply with fair housing laws.

Lease Terms: Project-based leases typically include more HUD-mandated provisions compared to voucher-based leases.

Both types of Section 8 investing provide stable income opportunities, but they cater to different investment strategies and risk preferences. Overall, project-based Section 8 properties require more direct compliance with HUD regulations and greater oversight. Investors should consider their goals and management capabilities when choosing between these two options.

Section 8 Investing - Misconceptions vs Facts

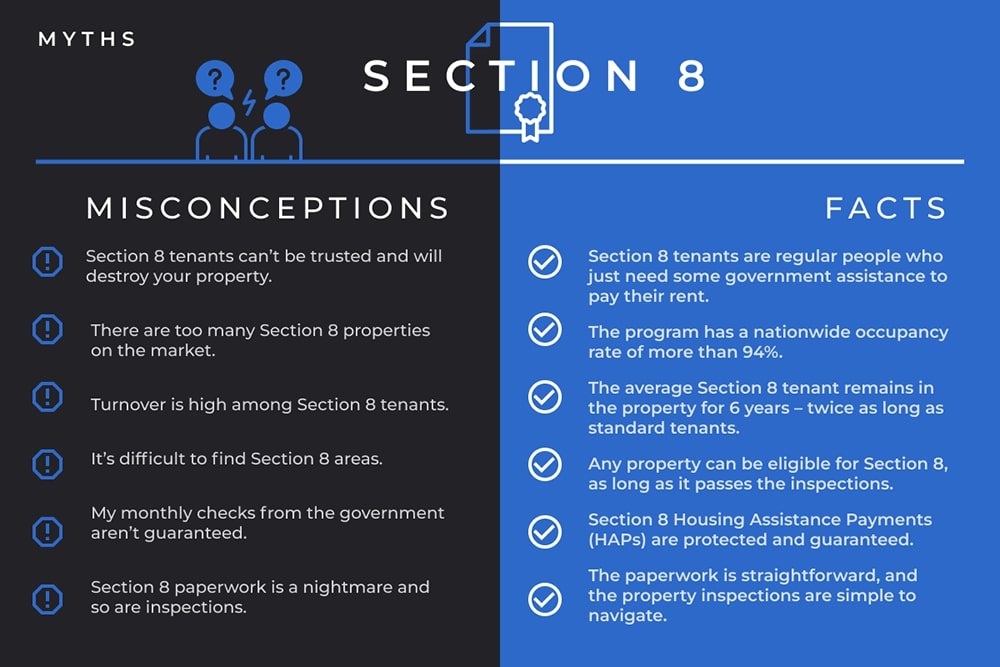

Myth #1. Section 8 tenants can’t be trusted and will destroy your property.

Any landlord can have bad tenants and Section 8 is no exception, but if you avoid buying property in high-crime neighborhoods, take care of your properties, and offer more than the bare minimum you can attract tenants who are more likely to take care of their home.

Long wait times to be accepted into the program generally discourage Section 8 tenants from doing anything that would cause them to lose their eligibility. If there is property damage, years of steady monthly checks from the government can make a few thousand dollars in repairs worth it.

Myth #2. If you rent to Section 8 tenants, you’re enabling people who want an easy handout.

Generally, Section 8 tenants are regular people who just need some government assistance to pay their rent. Many are near or at retirement age and simply need a place to live on a fixed income. In fact, 35% of public housing residents are over the age of 62.

Further, the tenant approval process requires a lot of effort, and there is plenty of oversight to ensure only people who need Section 8 housing receive it.

Here are some of the hoops tenants must jump through to become eligible:

Apply. They first must submit an application to the housing authority or property management company of the property where they want to live.

Submit documentation. This includes verification of income, citizenship status, family composition, and other eligibility criteria.

Wait. Applicants who are deemed eligible are usually put on a waiting list. Wait times can vary, but in Louisiana, for example, the waiting period can be as long as 12 years. Hundreds of thousands of Americans are currently on the waitlist.

Interview. Once selected from the waiting list, the applicant must attend an interview and provide further documentation if needed.

Finally receive approval and sign the lease. Upon approval, the tenant signs the lease and then must remain in compliance with the terms set forth by the housing authority.

Myth #3. There are too many Section 8 properties on the market, and soon there will be no tenants to fill them.

The Section 8 Program has been around for 50 years, since Congress amended the U.S. Housing Act of 1937.

Even after all these years, the program has a nationwide occupancy rate of more than 94%. The past half century has shown the program’s potential for longevity, and that’s unlikely to change anytime soon.

Myth #4. Turnover is high among Section 8 tenants.

This isn’t supported by data. In fact, the average Section 8 tenant remains in the property for 6 years, according to HUD. Meanwhile, tenancy in a standard single-family rental generally lasts 3 years, and multi-family tenants stay an average of 2.5 years before moving on.

This means landlords can expect Section 8 tenants to stay at least twice as long as standard tenants. And remember, every month that they occupy your property you are getting a steady check from the government.

Myth #5. Section 8 paperwork is a nightmare and so are inspections.

The paperwork is straightforward, and the property inspections are simple to navigate. What’s important is understanding exactly the types of properties you’re looking for and creating a system for handling the red tape. The inconveniences are minor and for most investors they are worth it for the rewards.

Myth #6. Section 8 never approves for the highest fair market rent (FMR).

If you don’t know how to negotiate with Section 8, you may wind up with an unsatisfactory deal. But negotiation is a skill you can easily learn.

On the other hand, relatively few landlords allow Section 8 tenants who are on the voucher-based program. In some cases this requires the federal government to pay above market rate to incentivize skeptical or reluctant landlords.

Myth #7. It’s difficult to find Section 8 areas.

Any property can be eligible for Section 8, as long as it passes the inspections. However, to reduce the chances of costly damages and other headaches, avoid purchasing rental properties in high-crime areas. To attract higher quality tenants, look to the suburbs. Consider purchasing properties that are 25-30 minutes outside of the city center.

Myth #8. None of the cities with $60-80k properties work with Section 8.

There are plenty of cities in the Midwest and South where you can see cash flow of $500-800 per month at that price range. This cash flow calculator can show you what to expect based on the number of Section 8 properties you own.

Myth #9. The government is on the verge of default, so my monthly checks aren’t guaranteed.

Your Section 8 Housing Assistance Payments (HAPs) are protected and guaranteed, whether the government defaults or not.

Myth #10. Dealing with government bureaucracy isn’t worth it.

While navigating Section 8 can seem complex at the beginning, you don’t need to be a genius to master it, and the rewards for getting through it are significant.

Trial and error is a great teacher, but that can get expensive quickly. To make it easy for property owners to get into Section 8 real estate investing, we guide them through the entire process.

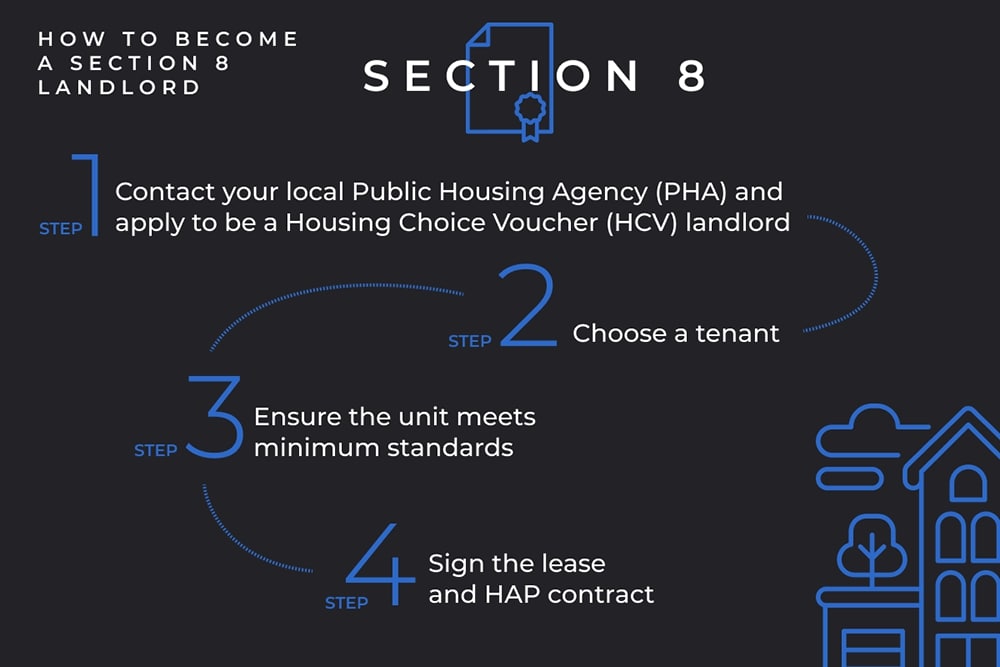

How to Become a Section 8 Landlord

The application and approval process involves navigating some federal red tape, but it’s relatively straightforward and booking a strategy session with us will save you some headaches.

Here’s the four-step process for becoming a Section 8 landlord:

Step 1. Contact your local Public Housing Agency (PHA) and apply to be a Housing Choice Voucher (HCV) landlord

The application process and rules for posting available units may vary depending on your location, but they will involve providing personal information and your asking price for your units. Your local office will fill you in on all the details. Here’s a directory of the PHAs for each state, and the HUD resource page for HCV landlords.

Step 2. Choose a tenant

Select a tenant from the PHA’s list of eligible households. You get to choose who moves into your properties. Then fill out the prospective tenant’s Request for Tenancy Approval form. Once the PHA has determined that your desired monthly rent is reasonable based on the current marketplace and meets other criteria, the agreement will be approved.

Step 3. Ensure the unit meets minimum standards

Your local PHA will come out and inspect any units or properties that you want approved for the Section 8 Program.

Some Section 8 landlords aim for the bare minimum standards in order to maximize profits. However, by investing a little more in your properties you can attract higher quality tenants and save yourself from property damages, eviction challenges, and other hassles.

That said, the bare minimum requirements for a Section 8 unit involve:

Sanitary facilities and conditions

Food preparation and refuse disposal

Space and security

Thermal environment

Illumination and electricity

Structure and materials

Interior air quality

Water supply

Lead-based paint

Access

Site and neighborhood

Smoke detectors

After you’ve passed the inspection, rent negotiations will begin. It’s important to know how to negotiate effectively so you can enter the agreement on the best possible terms. We can help you with this.

Step 4. Sign the lease and HAP contract

After both the landlord and tenant sign the lease agreement, the PHA will send a HAP contract for both parties to sign. After all the signatures are in place, you will start receiving monthly checks from both the PHA and your tenant.

Being a Section 8 Landlord – The Advantages

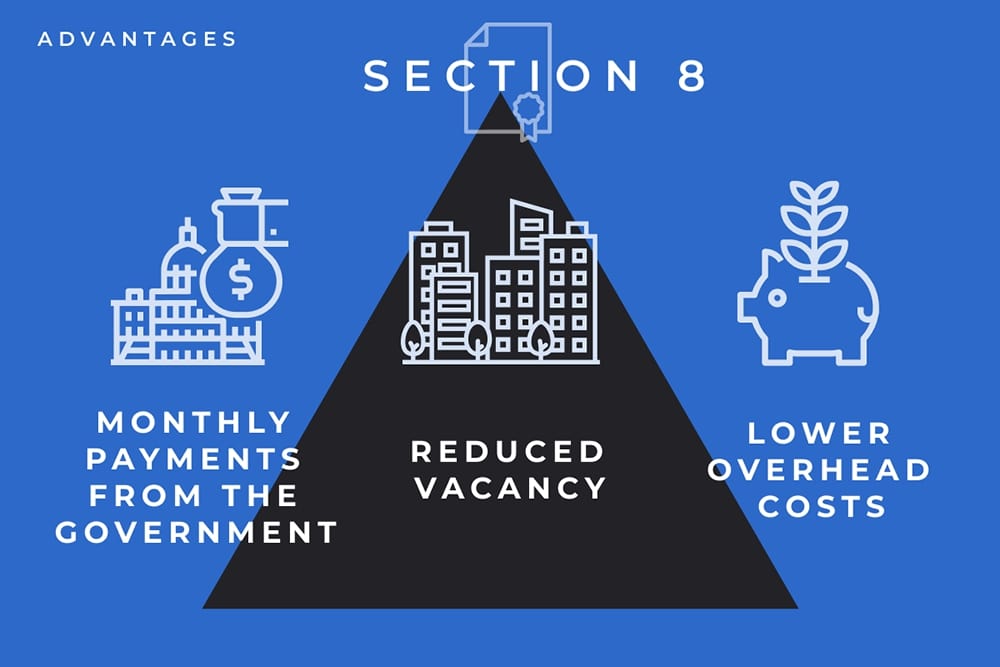

Once your property has been approved for Section 8 tenants, you can enjoy the following advantages.

1. Monthly Payments From the Government

No more chasing rent. Landlords are promised a monthly direct deposit from the federal government for as long as the unit is occupied by a Section 8 tenant.

The percentage of rent the program covers varies depending on the program and the tenant’s income level, but generally it ranges from 70% to 100%.

As a further incentive for landlords to accept Section 8 tenants, HUD periodically adjusts the FMRs to help ensure rents reflect current real estate market conditions. By aligning the payment standards with market rates, HUD indirectly raises rents for Section 8 tenants if the market rates increase.

2. Reduced Vacancy

In most cities, there is a long line of eligible Section 8 tenants waiting for available housing. After getting approved, Section 8 landlords can access the waitlist of local Section 8 tenants and hand-select who they want to move into their properties.

On the other hand, you can make potential tenants come to you by:

Listing your property online.

Putting up signs that say “I buy houses.”

Passing out flyers door to door.

With reduced marketing expenses, you can put that money back into the unit, toward purchasing additional properties, or into your pocket.

3. Lower Overhead Costs

Generally, Section 8 housing is less competitive for landlords than standard housing. There’s no need to upgrade the unit with state-of-the-art appliances or invest large amounts of money into renovations unless required to meet the minimum standards.

For example, you won’t lose a potential tenant because the flooring in the kitchen is a bit outdated or the flowerbeds failed to impress.

As long as the property is safe, sanitary, and provides basic amenities like hot water, smoke detectors, and a front door with a lock on it, you should have no trouble keeping your units occupied.

In many cases, there’s no need to provide a washing machine, dryer, dishwasher, refrigerator, or other value-adds. However, consider going somewhat above the basic requirements in order to attract tenants who are less likely to cause hassles. For example, consider offering a refrigerator.

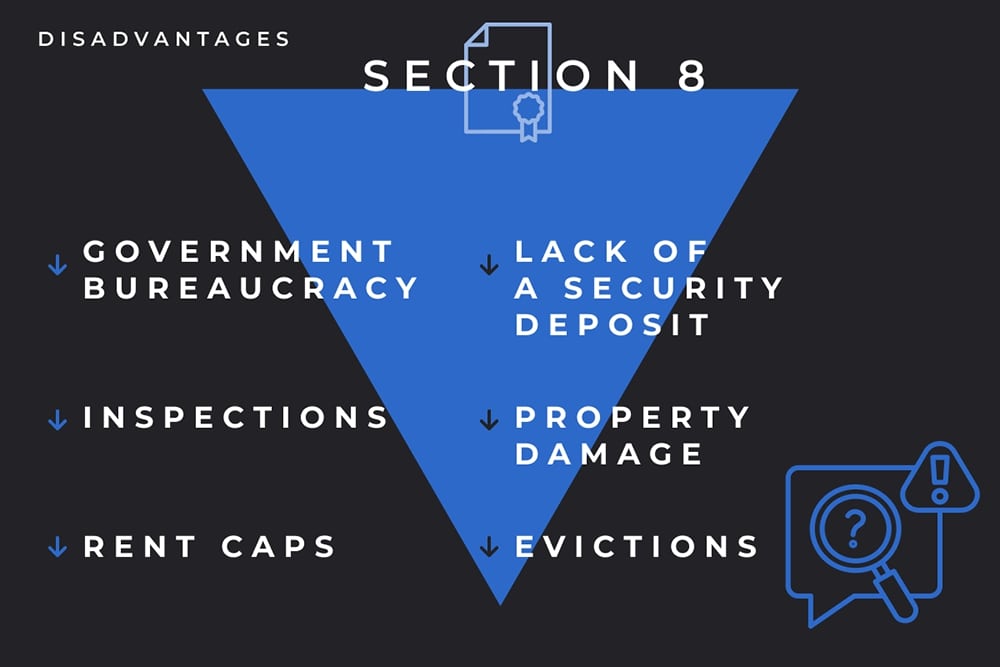

Being a Section 8 Landlord – The Disadvantages

Now that we’ve covered some of the advantages of being a Section 8 landlord, let’s look at some of the disadvantages. Whether any of these are a deal-breaker for you will depend on your level of experience and tolerance for challenges.

1. Government Bureaucracy

Paperwork is unavoidable when obtaining and maintaining your status as a Section 8 landlord. Approval can take months, plus another couple months to receive your first direct deposit from the government, and errors can lead to costly processing delays.

However, we can help ensure that all paperwork is filled out correctly to reduce these headaches.

2. Inspections

Mandatory regular inspections can lead to hassles and unexpected expenses if a problem is discovered. Scheduling inspections, and follow-up inspections to confirm any problems have been resolved, can be costly, frustrating, and distract from other responsibilities.

3. Rent Caps

HUD determines how much you are allowed to charge for rent, and it’s based on the FMR for the area. In some cases, this can be significantly less than a landlord could receive from a standard tenant. However, competition for available units can help justify higher rent prices.

Remember, the U.S. government is paying for 70% to 1000% of the tenant’s rent, and we can help you negotiate effectively to get the highest possible rent payments.

4. Lack of a Security Deposit

Unfortunately, the government does not subsidize security deposits, and many tenants won’t have the ability to pay for one even if you request it. This is potentially one of the most expensive cons of Section 8 investing.

If competition for units is high in your area, you may be able to select a tenant who will pay for a security deposit. However, it’s likely you’ll be responsible for paying for any damages that occur during their occupancy.

5. Property Damage

Most Section 8 tenants aren’t any more destructive than their open market counterparts. However, property damage – unintentional or otherwise – can occur, particularly in high-crime areas.

With no assurance of a security deposit, Section 8 landlords are at particular financial risk. If the tenant doesn’t take good care of the unit, repair costs may come out of the landlord’s pocket.

6. Evictions

Failure to pay rent, disruptive behavior, vandalism, and other criminal activities are reasonable grounds for eviction. But due to the rules of the Section 8 Program, it can be difficult to evict a tenant. One of HUD’s objectives is to keep people housed, so it’s no surprise that their eviction rules favor the tenant.

If you successfully evict a problem tenant they can contest it in court, which leads to more expenses of time and money.

Section 8 Investing FAQ

Here are answers to common questions about investing in Section 8 housing. If we don’t answer your questions here, contact us.

Is it profitable?

Section 8 investing can be highly profitable, but with any investment it’s important to do your due diligence, have a solid strategy, and navigate the challenges effectively. Cultivating a good relationship with your tenants goes a long way toward helping ensure a healthy return on investment.

How do I decide if Section 8 investing is right for me?

The goal isn’t to earn as much money as possible by offering tenants dangerous, unsanitary, poorly maintained housing.

That said, if your properties have a slightly outdated look or minor aesthetic issues, are in an unpopular area, or have fewer amenities than competing units, Section 8 can be a great way to increase occupation rates and ensure steady cash flow.

However, if your properties are particularly attractive and are located in desirable areas with low vacancy rates, you can probably earn more money and have fewer hassles on the open market.

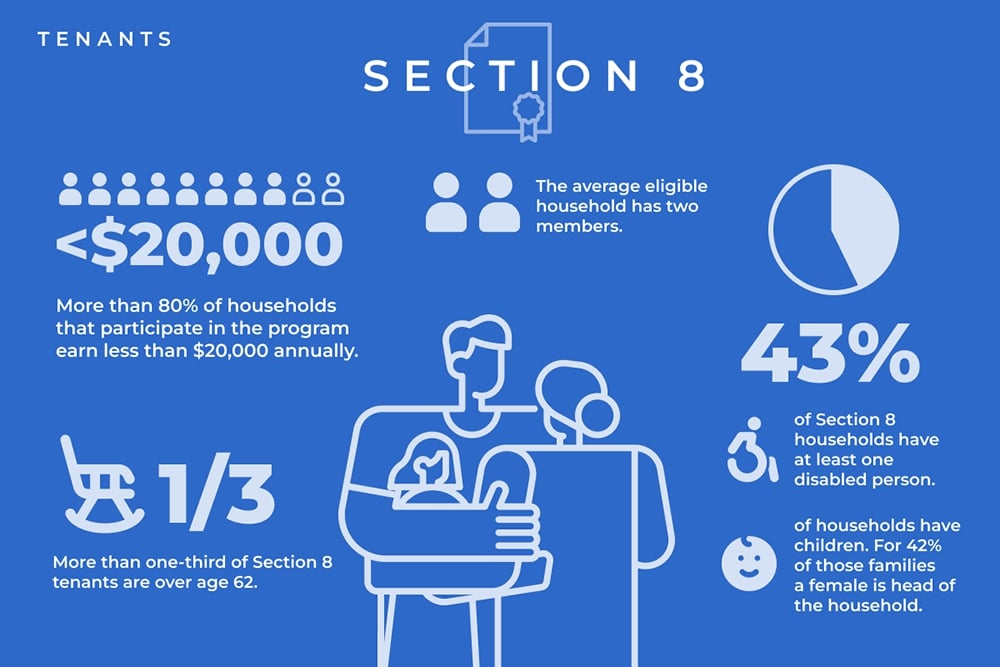

What types of people are in the Section 8 Program?

As we’ve said, most Section 8 tenants are regular people who are low-income and need government assistance to afford safe, sanitary housing.

The following Section 8 statistics show a clearer picture of who these renters are:

More than 80% of households that participate in the program earn less than $20,000 annually.

The average eligible household has two members.

43% of households have children, and for 42% of those families a female is head of the household.

43% of Section 8 households have at least one disabled person.

More than one-third of Section 8 tenants are over age 62.

What’s the best way to manage tenants?

While most Section 8 tenants are regular people who take pride in their home, some tenants may neglect or vandalize your property, or become a nuisance to other tenants.

To make sure everyone understands expectations, set clear rules upfront and enforce them. Outsourcing to a qualified, experienced property management company can help avoid major issues and deal with them if they arise.

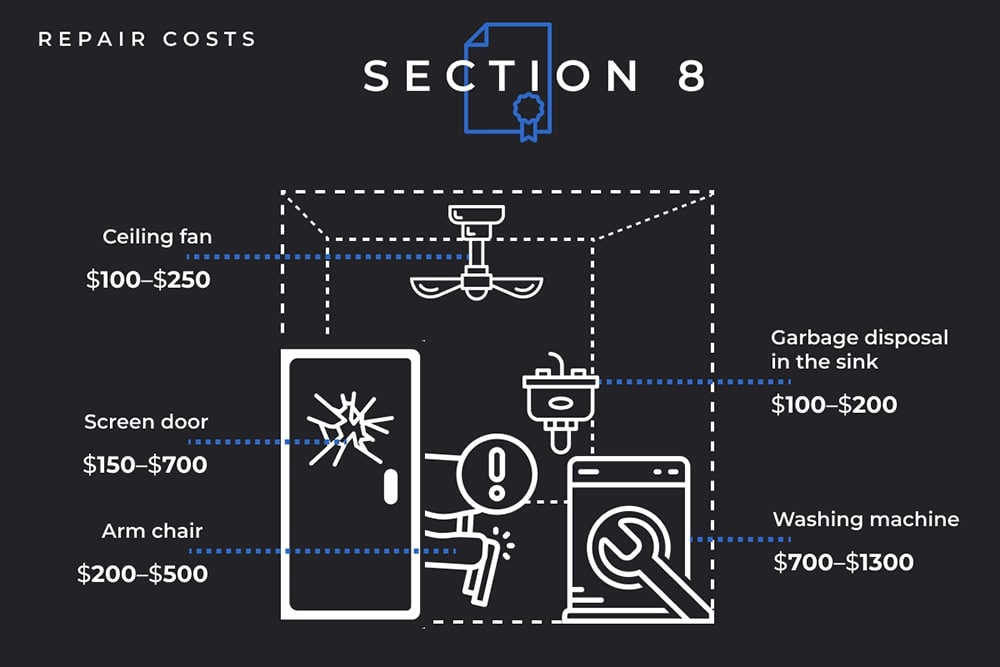

How can I avoid costly repairs?

As we’ve discussed, not renting properties in high crime areas and offering tenants more than the bare minimum in terms of aesthetics and appliances goes a long way toward attracting quality tenants who will take care of the property.

If the roof is leaking, the cabinets are unsightly, or the flooring is not up to its former glory, renovations today can reduce the chances of unexpected repair costs while the tenant occupies the property or after they vacate. Intentional damage, or damage caused by neglect, are more likely if the tenant feels their home is “trashy.”

Likewise, if you remove non-essential (and breakable) appliances and features before putting your unit up for rent, there’s no way a tenant can damage, lose, or steal them. Consider removing unnecessary furniture, screen doors, garbage disposals, ceiling fans, and other appliances. However, the comfort of your tenants is important so don’t go overboard.

Below are some common amenities that some Section 8 landlords choose not to include in the property, and the average price range for replacing those items if damaged:

While you get final say on who moves into your unit, it isn’t always possible to know what a tenant is like until after they’ve lived there for a while. Stay on top of things by regularly inspecting your properties. If you discover that you have a problem tenant, beginning the eviction process promptly will reduce the amount of damage they are likely to do – both to your investment property and to the other tenants’ quality of life.

How do I choose the best tenants?

Run a background check, credit check, and examine rental history before accepting a tenant.

Background Checks

Conducting a formal background check can be expensive, but it can be worth it to avoid problems down the road. Meanwhile, Google can reveal criminal history and give insights into the character of your potential tenant for free.

Income and Credit Checks

Typically, not all of the tenant’s rent will be covered by the program. So it’s important to be sure your new tenant can pay before handing them the keys.

Your tenant should earn at least three times as much as their portion of the rent. For example, if the tenant is responsible for paying $250 per month, they should earn $720 per month to ensure they have enough money to pay their part of the rent on time. Likewise, a credit score of 650 or higher is ideal.

Rental History

Check potential tenants’ rental history to see if they’ve moved around a lot, been evicted, or had other problems with past landlords. Calling their previous landlords, with their permission, can reveal red flags before they become costly problems.

Inspections

Due to the competitive Section 8 landscape, you can make onsite visits to potential tenants’ current home part of your screening process. If they are treating their current property well, that’s a good sign.

However, if you or your property manager sees issues like broken doors, cigarettes everywhere, or excessive numbers of animals on the property, those are indications the tenant might not take good care of your property.

How can you acquire properties at the cheapest rates?

Off-market deals can be very cheap. By cold-calling property owners in distressed situations, you can make an offer to motivated sellers before their home hits the market.

Plus, it’s possible to acquire a property at no cost through the HUD Public Housing Program. These properties are sold to buyers who will live in the unit for a one-year minimum. But if no one purchases the unit after 30 days it’s transferred to investors who can offer you the property at shockingly low rates.

How Recession Proof Blueprint Can Help

Whether you're a seasoned investor or just starting out, Recession Proof Blueprint can provide valuable insights, help you make informed decisions, and guide you through the process step by step, maximizing your returns in the Section 8 housing market.

Schedule a strategy session today.