40 Section 8 Statistics, Trends, and Predictions for 2025

Section 8, also known as the Housing Choice Voucher Program (HCV), helps millions of Americans secure safe, decent housing by subsidizing a portion of their rent in privately owned homes and multifamily dwellings.

Administered by the U.S. Department of Housing and Urban Development (HUD), Section 8 is a critical resource to provide affordable housing to low-income families, elderly individuals, and people with disabilities.

For property owners, Section 8 investing is an opportunity to benefit from a high-demand market and secure stable income from the U.S. government.

As someone who’s gone from working for Section 8 to owning more than 100 Section 8 properties over the course of just a few years, I understand how important it is to understand Section 8 statistics.

Not only do they offer critical insights for property investors, housing advocates, and policymakers, but they also help draw a clear picture of:

The reach and effectiveness of the rental assistance program.

Advantages of housing Section 8 tenants versus traditional tenants.

Other benefits of becoming a Section 8 landlord.

At Recession Proof Blueprints, we’ve put together 40 statistics that shed light on the demographics of those served, a state-by-state overview of housing assistance, and the financial implications for both tenants and landlords.

Let’s get started.

Section 8 Housing Statistics - Key Findings

It’s important to remember that these statistics are not just numbers, but they represent real people who have found safe, affordable housing through the Section 8 program.

1. Approximately 2.3 million U.S. households receive Section 8 housing vouchers (source)

This figure specifically refers to the number of households participating in the Section 8 Housing Choice Voucher Program. Of households receiving new vouchers, approximately 75% are classified as having extremely low income.

These vouchers allow eligible low-income households to choose and rent privately owned housing, with the government subsidizing part of the rent. The tenant pays typically 30% of their income toward rent and utilities, and the federal government pays landlords the rest of the amount.

2. 3 million U.S. households rent Section 8 residences (source)

This refers to households living in Section 8 housing, which can include both voucher recipients who rent private homes and those in project-based Section 8 housing, where the rental assistance is tied to a specific property rather than a mobile voucher.

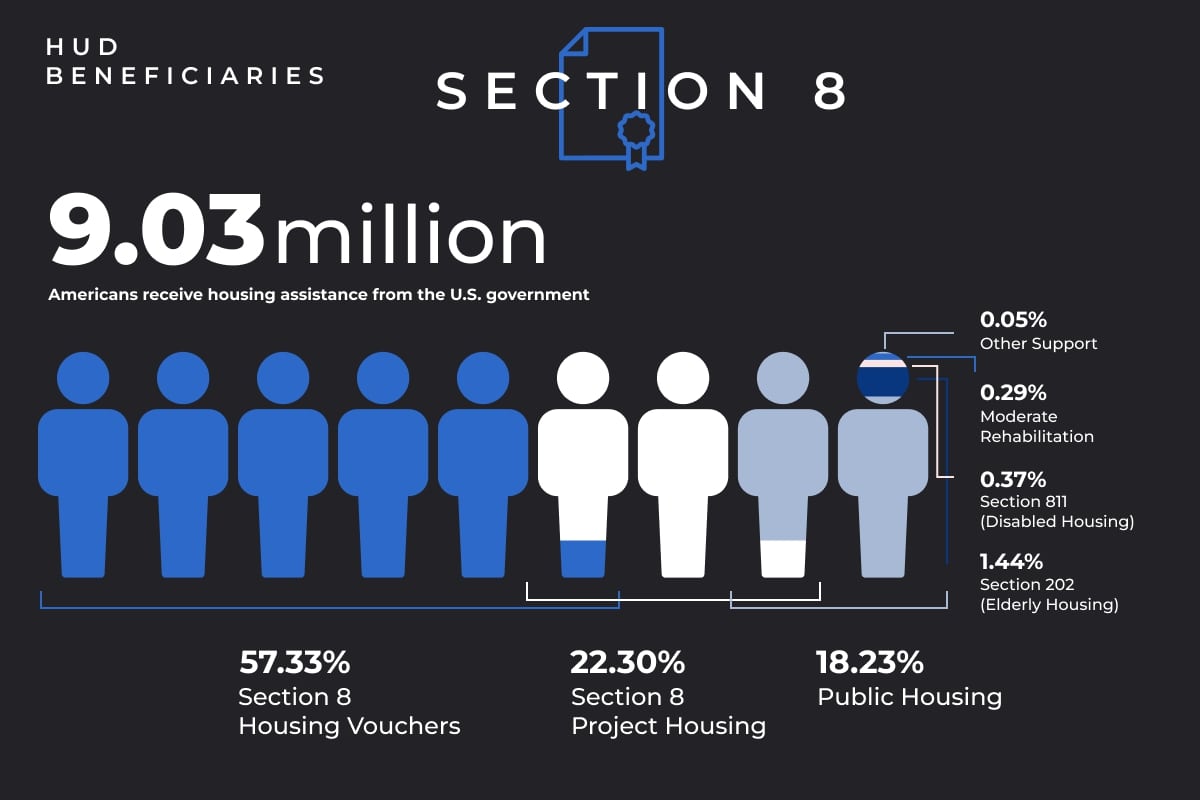

3. A total of 9.03 million Americans (4.8 million households) receive housing assistance from the U.S. government (source)

This broader statistic represents 2.71% of the American population and includes not only Section 8 voucher recipients but also other forms of federal housing assistance. Here’s the full breakdown:

Section 8 Housing Vouchers: 57.33%

Section 8 Project Housing: 22.3%

Public Housing: 18.23%

Section 202 (Elderly Housing): 1.44%

Section 811: (Disabled Housing): 0.37%

Moderate Rehabilitation: 0.29%

Other Support: 0.05%

Combined, these programs are a valuable resource for American families. However, this figure decreased from 2022, when 10.2 million people in 5.2 million households received housing assistance.

4. A total of 1,315,607 residences were available for Section 8 renters in 2023 (find new source)

According to HUD data, in 2023 there were over 1.3 million units available for rent to low-income households that qualified for Section 8.

5. 91% of Section 8 units were occupied in 2023 (find new source)

This represents a 9% vacancy rate, which was higher than the vacancy rate of all rental housing that year, but shows there is high demand for Section 8 housing in the U.S. Here’s a breakdown of vacancy rates for all rental housing units in various regions around the United States in the fourth quarter of 2023:

Northeast: 4.3%

Midwest: 6.8%

South: 8.7%

West: 5.1%

Section 8 Statistics by State

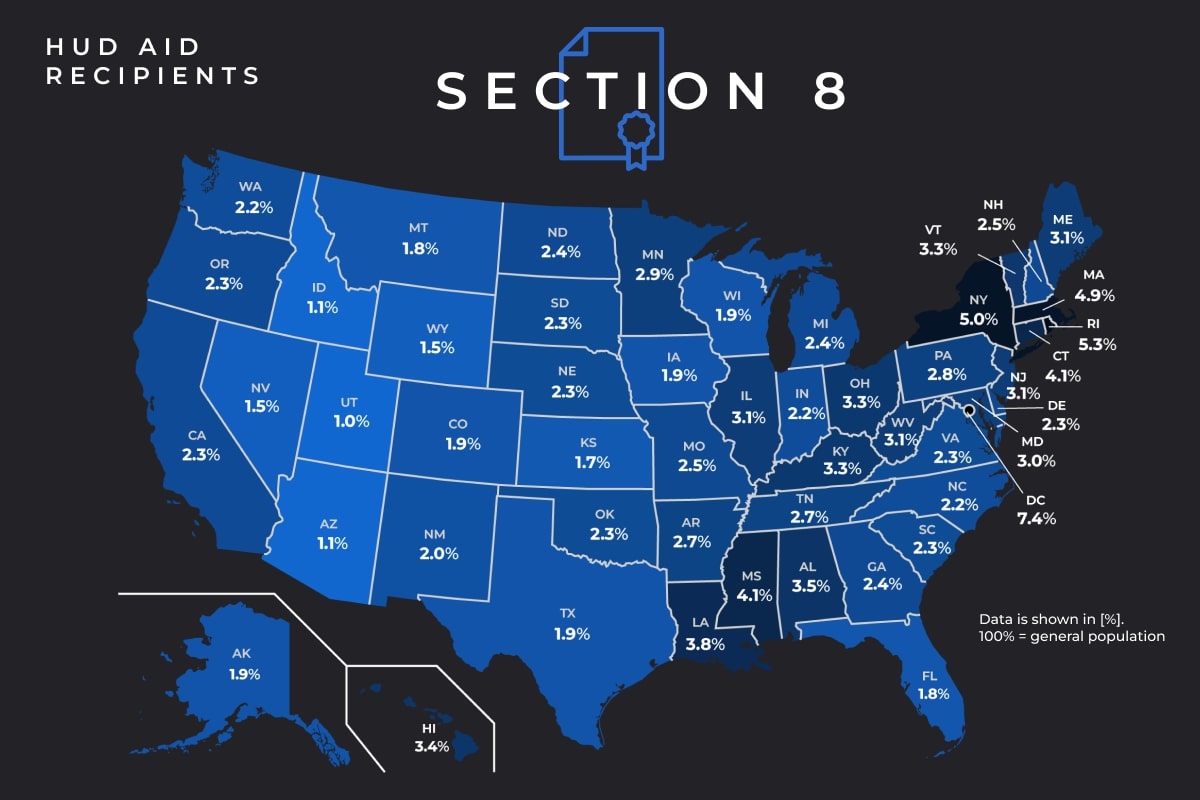

6. Washington, DC has the highest rate of HUD participation per capita, at 7.4% of the population (source)

However, while Washington, DC has the highest rate of participation, it has one of the lowest rates of program utilization, at 76%, meaning that the participation rate could be much higher if the programs were more effectively utilized and occupancy rates were increased.

7. Rhode Island is the state with the highest participation rate across HUD programs (source)

Per capita, there is a higher rate of HUD participants in Rhode Island than any other state.

The following is a breakdown of the top states for HUD programs including Section 8. This ranking is based on the percentage of the population that receives federal housing assistance. We included 11 due to a three-way tie among Kentucky, Ohio, and Vermont.

Rhode Island: 5.3%

New York: 5%

Massachusetts: 4.9%

Connecticut: 4.1%

Mississippi: 4.1%

Louisiana: 3.8%

Alabama: 3.5%

Hawaii: 3.4%

Kentucky: 3.3%

Ohio: 3.3%

Vermont: 3.3%

8. Utah has the lowest rate of HUD participation, at 1% (source)

In addition to Utah, in many U.S. states less than 2% of the population participates in HUD programs, including Section 8. Our list of states with the lowest participation rates includes 13 rather than 10 due to a five-way tie among Alaska, Colorado, Iowa, Texas, and Wisconsin.

Utah: 1%

Arizona: 1.1%

Idaho: 1.1%

Nevada: 1.5%

Wyoming: 1.5%

Kansas: 1.7%

Florida: 1.8%

Montana: 1.8%

Alaska: 1.9%

Colorado: 1.9%

Iowa: 1.9%

Texas: 1.9%

Wisconsin: 1.9%

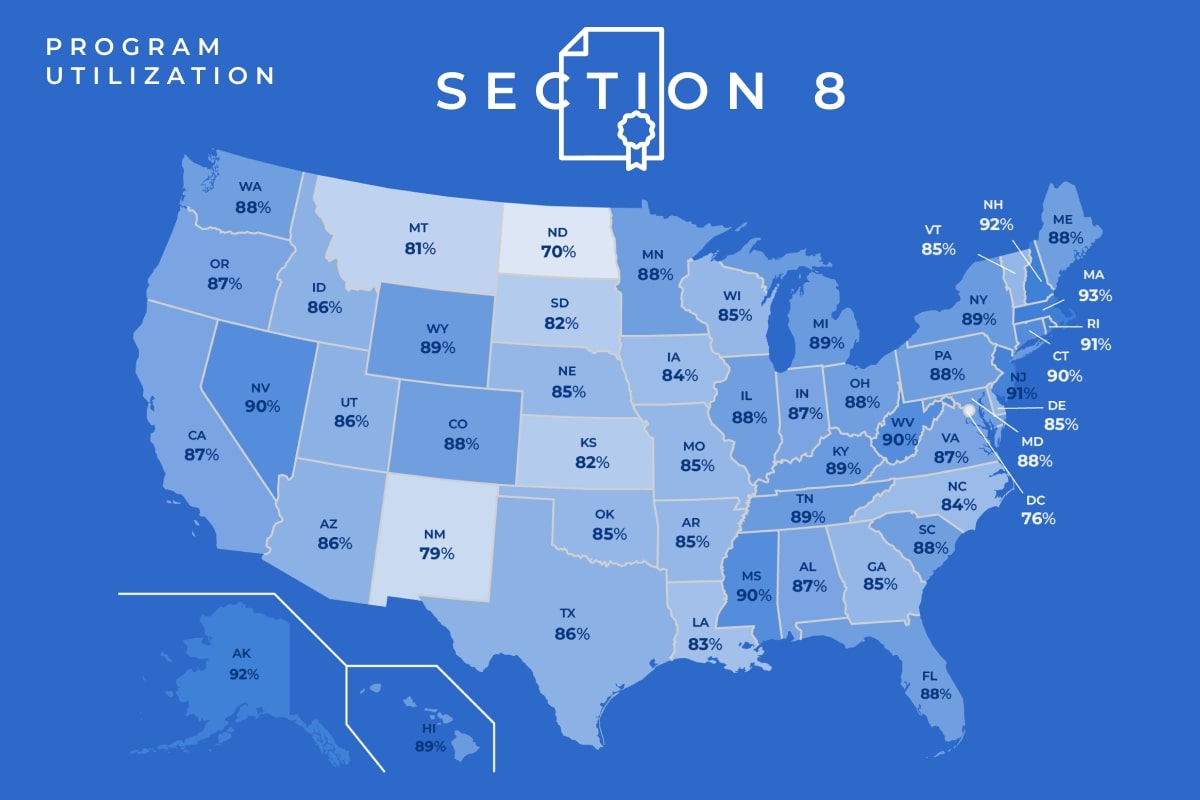

9. Massachusetts has the highest occupancy rate for government-assisted housing, at 93% (source)

This means that 93% of housing units in Massachusetts that are eligible for programs like Section 8 are occupied.

The following is a list of the top states by HUD program utilization. There was a five-way tie on this list as well, with Hawaii, Kentucky, Michigan, New York, and Wyoming all at 89% occupancy:

Massachusetts: 93%

New Hampshire: 92%

Alaska: 92%

Rhode Island: 91%

New Jersey: 91%

Connecticut: 90%

Nevada: 90%

West Virginia: 90%

Mississippi: 90%

Hawaii: 89%

Kentucky: 89%

Michigan: 89%

New York: 89%

Wyoming: 89%

10. North Dakota has the lowest occupancy rate for eligible units, at 70% (source)

The following is a list of U.S. states that are serving households at the lowest capacity and have the most room to increase utilization of HUD programs like Section 8.

North Dakota: 70%

New Mexico: 79%

Montana: 81%

Kansas: 82%

Louisiana: 83%

North Carolina: 84%

Arkansas: 85%

Delaware: 85%

Georgia: 85%

Vermont: 85%

Who Needs Section 8 Housing?

11. 23.4 million low-income Americans are homeless or pay more than 50% of their income for housing (source)

Due to shortfalls with federal funding, most of the 10.9 million low-income households don’t receive federal housing assistance. As a result, many skip medicine, food, and other necessities to pay rent.

Based on criteria set by the U.S. government, housing is considered unaffordable if rent is more than 30% of the household’s income.

12. 1.4 million children in the U.S. live in unstable housing (source)

This figure represents children who are currently housed but are at risk of becoming homeless due to economic hardship or lack of affordable housing.

13. Over a 5-year time period, approximately 3.7% of veterans experience homelessness (source)

According to VA.gov, this rate is more than double for veterans who are not married or have been diagnosed with a drug use disorder.

14. People living on Native reservations are twice as likely to be in poverty and three times as likely to live in overcrowded housing (source)

Also known as “Indian country,” these areas include all lands within the limits of Native reservations.

15. The Section 8 waiting list can take more than 10 years (source)

Depending on the state and county, it can take more than a decade for a Section 8 applicant to reach the front of the line. Once they’ve received their voucher, they will have a limited amount of time (typically a matter of months) to find housing.

What makes it even more difficult for people who need housing is the fact that many states are currently closed to applications, meaning it’s impossible to even get on the waitlist. This massive unmet demand, and the limited availability of Section 8 units, makes the need for Section 8 landlords even more critical.

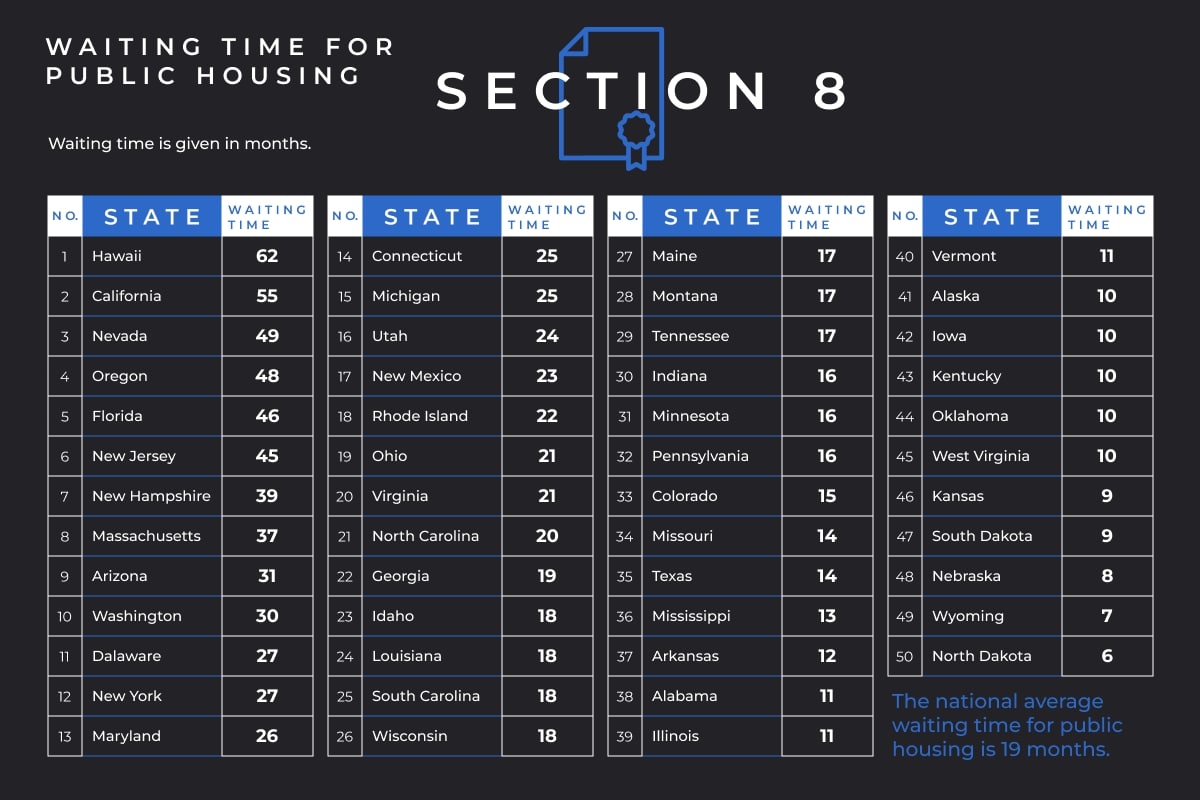

16. The national average wait time for public housing is 19 months (source)

However, in many states the average wait time is much longer, as public housing agencies deal with a backlog of applications. Here are the states with the longest wait times for public housing:

Hawaii: 62 months

California: 55 months

Nevada: 49 months

Oregon: 48 months

Florida: 46 months

On the other hand, here are the states with the shortest wait times:

North Dakota: 6 months

Wyoming: 7 months

Nebraska: 8 months

South Dakota: 9 months

Kansas: 9 months

While Section 8 properties are privately owned, public housing is owned and operated by the local Public Housing Authority (PHA). Long wait times for the public housing, and the fact that these are typically in designated public housing developments, can make Section 8 a more attractive housing option for low-income renters.

Who Uses Section 8 the Most?

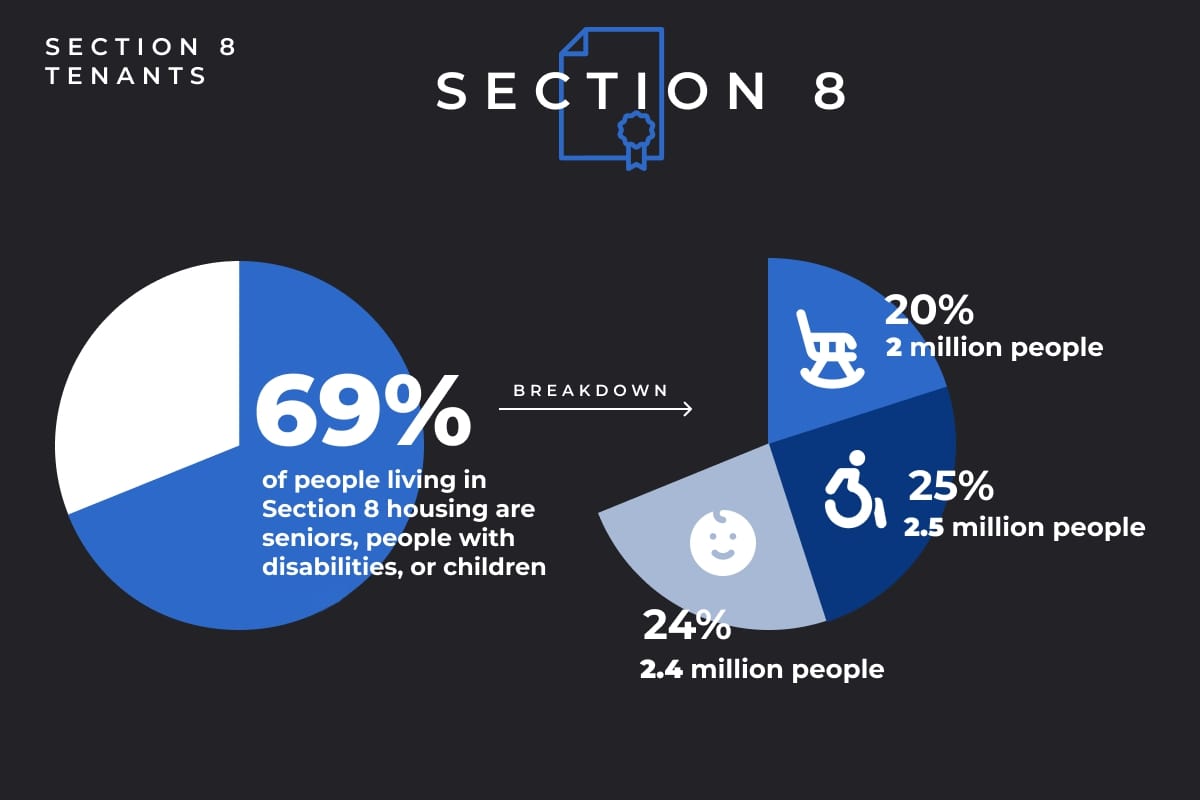

17. In 2022, 69% of people living in Section 8 housing were seniors, people with disabilities, or children (source)

Generally, this represents non-working individuals, or people with reduced work opportunities due to age or retirement status, or physical or mental disabilities.

Here’s the breakdown:

Senior citizens: 20% of Section 8 residents, representing 2 million people.

People with disabilities: 25% of Section 8 residents, representing 2.5 million people.

Children: 24% of Section 8 residents, representing 2.4 million people.

Section 8 allows these individuals to age in place, live independently, or have safe housing with their adult guardians.

18. In 34% of HUD-assisted households where the head, spouse, or co-head is age 61 or younger, they have a disability (source)

That percentage increases to 47% for households where the head, spouse, or co-head are over age 61.

Meanwhile, in 24% of households that receive government assistance for housing, every member of the household has a disability.

19. 58% of people who receive HUD assistance are families with children (source)

More than half of individuals receiving federal housing assistance are people in families that include children. This represents 6 million people who are able to avoid homelessness due to federal aid programs like Section 8.

20. Voucher-based Section 8 provides housing to nearly 80,000 formerly homeless veterans (source)

As of 2023, approximately 79,000 veterans who were formerly experiencing homelessness lived in stable, affordable housing due to the voucher-based subsidy.

21. More than half of households receiving rental assistance include at least one working adult (source)

Approximately 55% of recipients in non-disabled households with working-age adults have at least one employed household member who is bringing income into the home.

22. Hawaii has the largest government-assisted households, with an average of 2.4 individuals living in each unit (source)

Meanwhile, Wyoming, Rhode Island, and New Hampshire are tied for the smallest households, with an average of 1.6 residents living in each unit.

Section 8 Statistics by Gender

23. 74% of households that receive housing assistance are female-led (source)

Among Section 8 housing tenants, women are most likely to be the head of the household. This percentage goes up to 77% for voucher-based Section 8 recipients, but decreases to 70% for project-based recipients.

However, the majority of these are single-person households, meaning a woman is living alone in HUD-assisted housing.

24. 30% of HUD-assisted households are female led with children (source)

The percentages for voucher-based and project-based Section 8 are 35% and 23%, respectively.

However, interestingly, statistics show identical percentages in all three segments for households consisting of one adult with children. This indicates that a negligible percentage of HUD users are single men with children.

Meanwhile, only 3% of HUD-assisted households are two or more adults with children.

Section 8 Statistics by Race

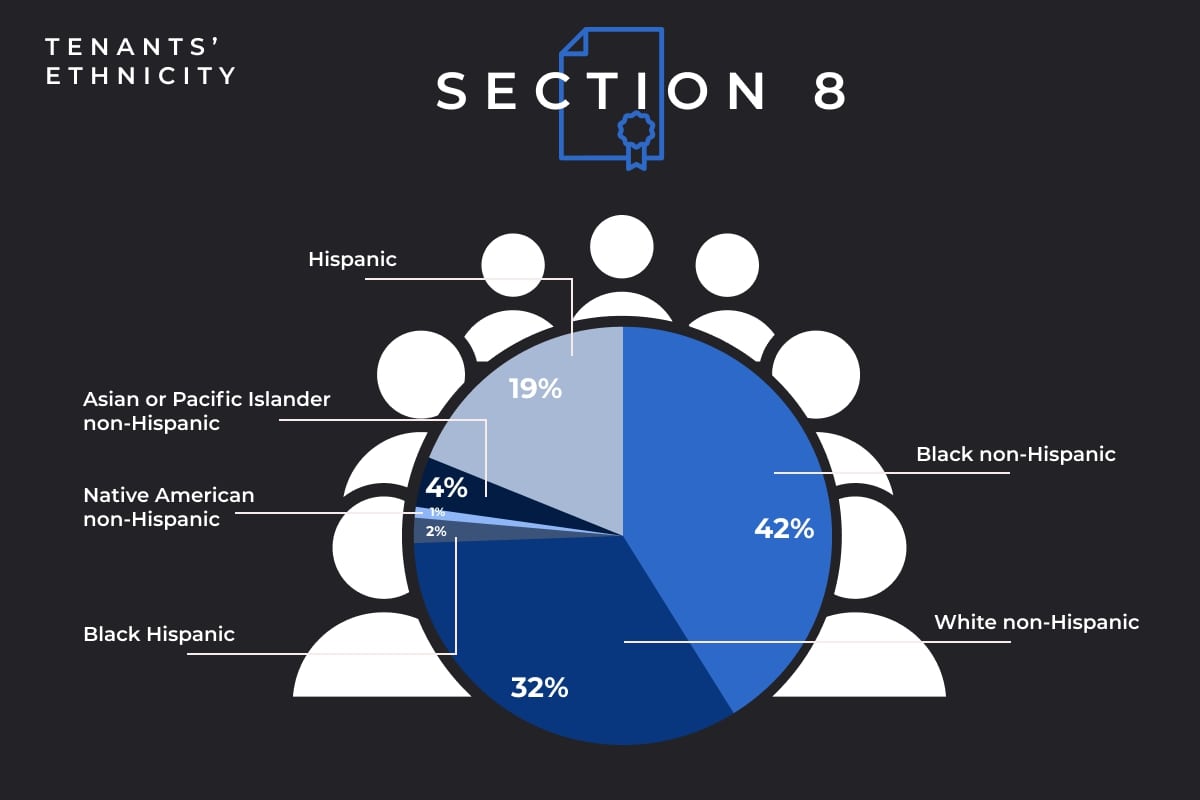

25. Two thirds of HUD recipients are from a racial or ethnic minority (source)

Approximately 66% of housing assistance recipients self-report being members of a racial or ethnic minority. This percentage rises to 70% for voucher-based Section 8 recipients but decreases to 57% for project-based recipients.

Here’s the breakdown based on HUD recipients as a whole:

Black non-Hispanic: 42%

White non-Hispanic: 32%

Black Hispanic: 2%

Native American non-Hispanic: 1%

Asian or Pacific Islander non-Hispanic: 4%

Hispanic: 19%

Based on this data, we can see that Black non-Hispanic individuals make up the largest segment of HUD recipients. Across the board, these numbers are consistent with Section 8 recipients, with a deviation of fewer than three percentage points for any segment.

White non-Hispanic individuals comprise the second largest segment, at slightly more than two thirds, followed by Hispanic individuals at nearly one in five.

Section 8 Statistics by Age

26. Participation in federal housing assistance programs plummets for people aged 51 to 60 (source)

Across all HUD programs, 38% of participants are between the ages of 25 and 49. That percentage is relatively consistent for participants aged 62 and older, at 41%.

However, the 51 to 60 age group represents only 18% of housing assistance recipients. That’s roughly half of the representation among younger and older recipients.

Meanwhile, the age segment with the lowest representation is participants aged 24 or younger, at just 3%.

The minimum age for eligibility is 18.

27. The largest segment of Section 8 recipients is age 62 or older (source)

These percentages are based on the recipient being the head of the household or a spouse.

Here’s the full breakdown:

3.5% are age 24 or younger

36.5% are age 25 to 49

17% are age 51 to 60

43% are age 62 or older

4% are age 85 or older

28. Section 8 recipients older than retirement age are much more likely to be project-based (source)

More than half of project-based Section 8 recipients are age 62 or older, at 53%. And 7% are aged 85 or older. This is more than triple the rate of people aged 85 and older who participate in voucher-based Section 8 (2%).

Meanwhile, only 33% of participants aged 62 or older are housed through voucher-based, or tenant-based, Section 8.

29. Working age recipients are generally more likely to participate in voucher-based Section 8 – except for the youngest segment (source)

Among voucher-based Section 8 recipients, 44% are aged 25 to 49, while only 29% of project-based recipients are in the same age range.

Note that only heads of households or spouses are included in these percentages.

Further, 21% of voucher-based recipients are aged 51 to 60, while this age group comprises only 13% of project-based recipients.

However, this trend reverses among recipients aged 24 or younger, with this age group representing 5% of project-based recipients but only 2% of voucher-based. A contributing factor for this exception in the youngest segment may be long wait times for Section 8 vouchers.

It’s possible that they simply haven’t been eligible for long enough to receive a voucher, which points to the need for Section 8 expansion to shorten wait times and help families and individuals enter safe, stable housing sooner.

Section 8 Statistics by Tenant Income

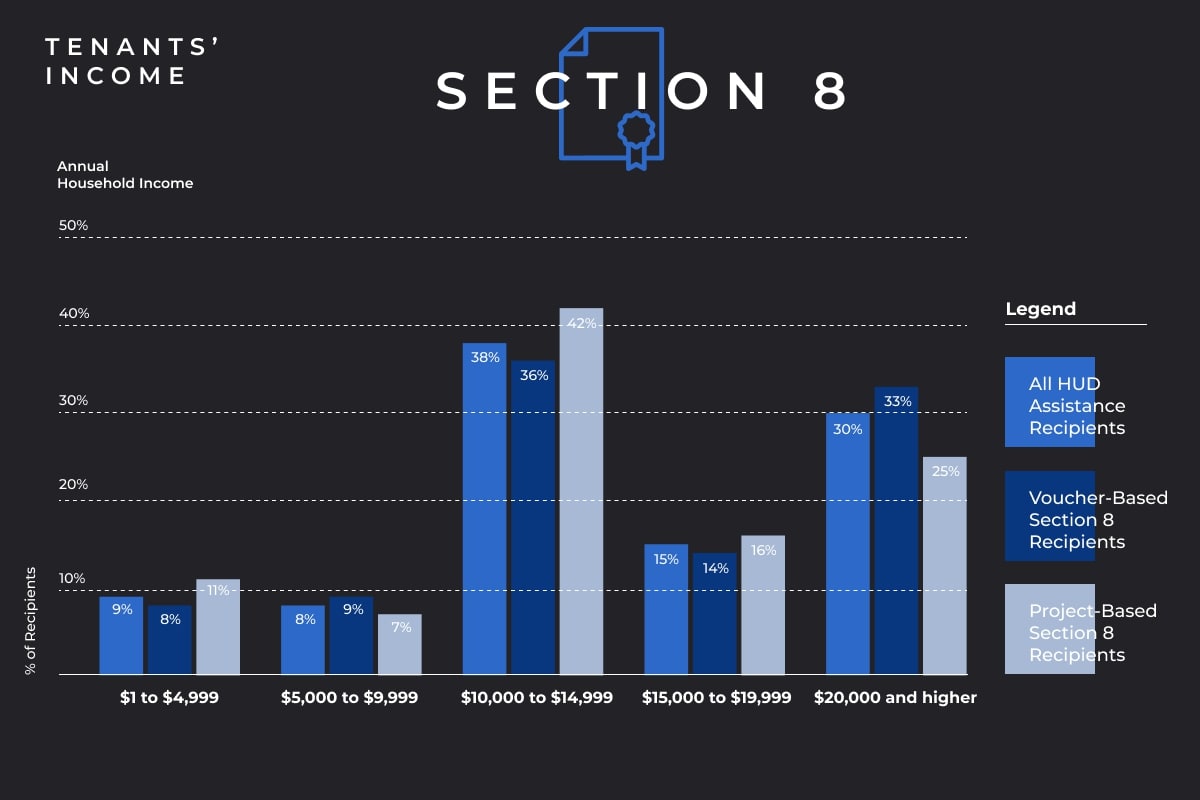

30. Average annual income for HUD-assisted households is $17,201 (source)

For households receiving voucher-based Section 8, this amount is slightly higher at $17,825. However, households on project-based Section 8 have a lower average annual income at $15,455.

This breaks down to an average annual income of $8,690 per person across all HUD recipients, a lower average of $8,170 for individuals in voucher-based households, but a higher average for individuals in project-based households at $9,311.

For households in all segments, the most common income range is $10,000 to $14,999, at 38% for all HUD recipients, 36% for voucher-based Section 8 recipients, and 42% for project-based Section 8 recipients. However, the second-most common income range is $20,000 and higher, at 30%, 33%, and 25%, respectively.

Here’s the full breakdown of annual household income across all HUD recipients, voucher-based Section 8 recipients, and project-based Section 8 recipients:

31. Welfare is a major source of income for just 3% of HUD users (source)

As for recipients of voucher-based and project-based Section 8, that percentage is just 4% and 2%, respectively.

Contrary to certain perceptions, housing assistance recipients are much more likely to rely on wages as a major source of income than welfare. Wages are a major source of income for 24% of HUD-assistance recipients. For voucher-based Section 8 recipients the percentage increases to 28% but decreases to 17% for project-based.

The majority of HUD-assistance recipients (67%) rely on other sources of income. Meanwhile, this percentage is 62% for voucher-based Section 8 recipients and 77% for project-based.

32. Approximately 77% of households that receive HUD assistance are considered ‘extremely low income’ (source)

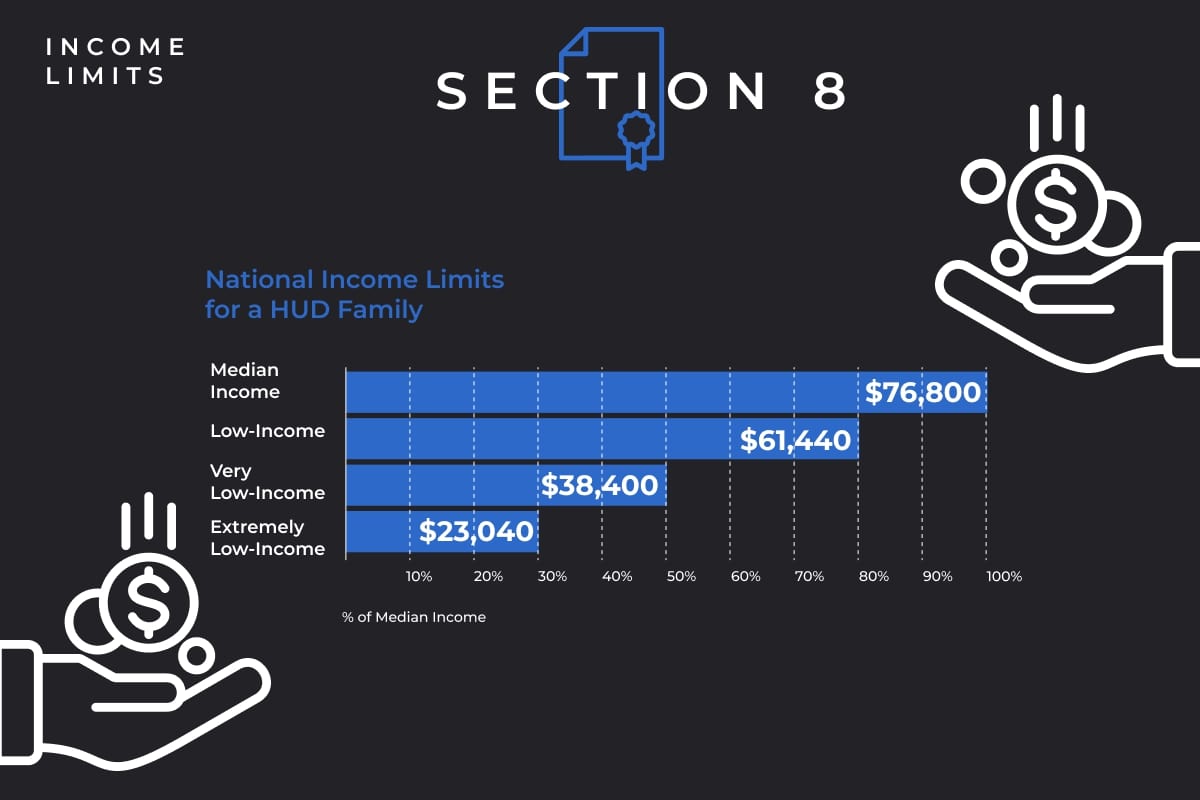

To be considered “extremely low income,” a household must have less than $23,040 in income annually. Meanwhile, 77% of voucher-based Section 8 recipients are placed in the same segment, and 79% of project-based recipients.

Here’s a breakdown of the income limits set by HUD:

On average, HUD-assistance recipients earn 22% of the local median household income. For both voucher-based and project-based Section 8 recipients, that percentage is slightly lower at 21%.

How Much Does Section 8 Cost the U.S. Government?

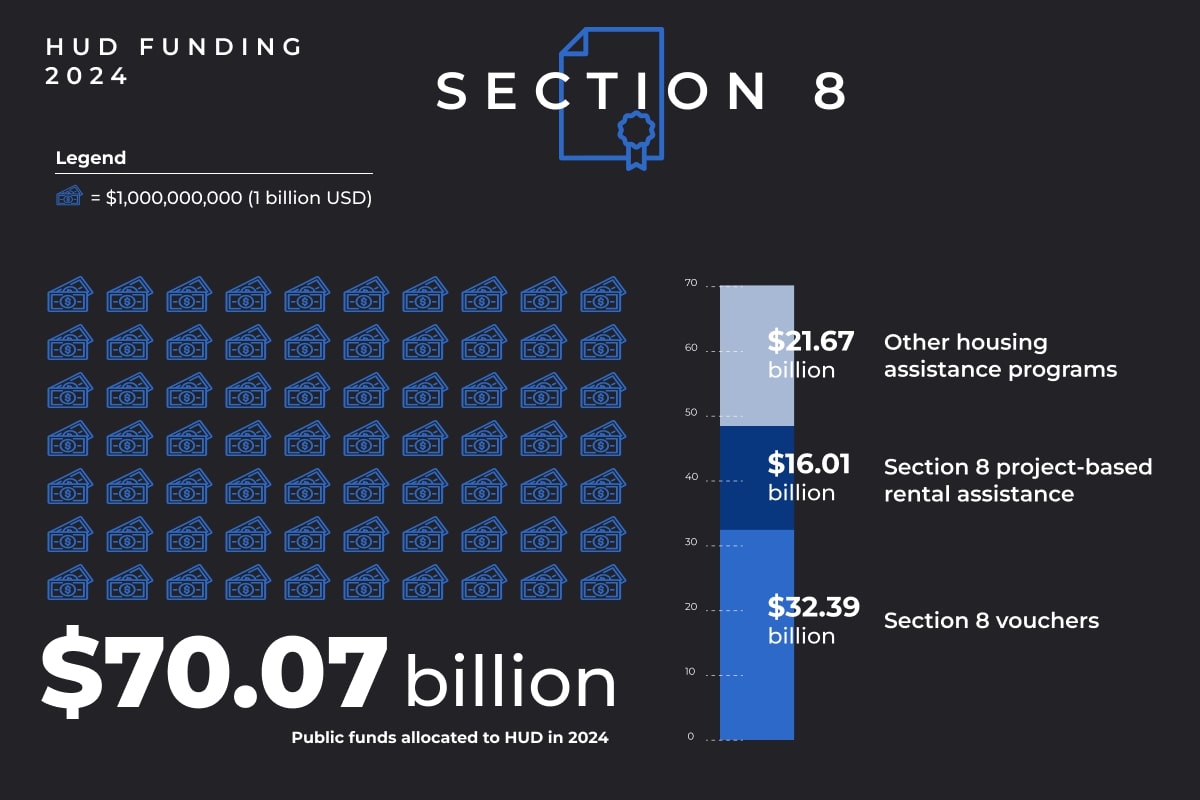

33. HUD received $70.07 billion in funding for fiscal year 2024 (source)

The funding is intended to maintain existing rental assistance while expanding programs to increase access to safe, affordable housing, and to attract more landlords to Section 8.

This is an increase from $48.5 billion in 2020.

The money includes:

$32.4 billion for voucher-based Section 8, a $2.1 billion increase year-over-year. This will provide 3,000 incremental vouchers to veterans and youth aging out of foster care.

$16 billion for project-based Section 8, a $1.1 billion increase year-over-year.

$8.8 billion for operational needs, a $297 million increase.

34. $4.05 billion of 2024 federal budget was earmarked for Homeless Alliance Grants (source)

The bill includes $4.05 billion for Homeless Assistance Grants, a $418 million increase year-over-year.

Additionally, the bill includes:

$100 million earmarked for permanent supportive housing, such as Section 8, a 25% increase over the previous fiscal year.

$25 million toward inflationary adjustment for service projects.

$2.5 million to provide technical assistance to connect homeless people to housing and related services.

35. The HOME Investment Partnerships Program was given $1.25 billion from the 2024 budget (source)

Despite the dramatic cuts proposed by the House, this program was given well over $1 billion for fiscal year 2024 to address the shortage of affordable, subsidized housing. This funding will give state and local governments the resources to build over 7,000 new homebuyer and rental units, including Section 8 units.

36. The 2024 budget directs $6.7 billion to meet affordable housing and community development needs (source)

This money was earmarked for economic development initiatives and the Community Development Block Grant formula program.

37. A record $1.3 billion was approved for the Native American Housing Block Grant program (source)

The program received a massive $1.344 in funding from the budget for the 2024 fiscal year. As mentioned earlier in this article, poverty rates are nearly double on native reservations compared to the rest of the U.S. Likewise, the rate of people living in overcrowded housing is nearly triple. This funding will help address these dire needs.

38. The ‘Yes in My Back Yard’ grant program received $100 million – a $15 million increase (source)

Formed in 2023, the YMBY grant program seeks to remove barriers to affordable housing production to keep up with market demand. These barriers include state and local laws and regulations governing zoning and land use. Removing these barriers will help local jurisdictions construct more housing, including Section 8, and lower costs.

Section 8 Housing and Crime Statistics

39. Research shows that more Section 8 vouchers doesn’t lead to more crime (source)

Section 8 housing crime statistics show no causation between an increase in voucher holders and an increase in crime.

In other words, when crime rates rise, Section 8 housing isn’t driving the increase. More likely, it’s a lack of opportunities for employment, quality schools, and other amenities.

A significant number of Section 8 units happen to exist in high crime areas, which has fueled the myth that the existence of Section 8 housing in a neighborhood leads to higher crime rates. It’s important to correct this misconception, as it can drive area homeowners and policymakers to stand in the way of Section 8 expansion.

40. An increase in crime leads to a small increase in voucher holders – a reverse of the stereotype (source)

Generally, for every six additional incidents of crime in a 12-month period, there will be one additional voucher-holder living in the area the following year.

However, datasets don’t seem to show a connection between the rise in crime and the individual voucher holders. A possible connection is that rising crime rates lower property values, which lowers the rent and makes it more likely that skeptical landlords will rent to voucher holders.

Section 8 voucher holders are regular people who simply need assistance to access safe, affordable, low-income housing. Same as anyone else, they deserve to live in a safe neighborhood.

We advise Section 8 property investors to look outside of high crime neighborhoods, focusing on safer neighborhoods in the suburbs. This is not only a wise investment choice, but it also provides safer housing and a higher quality of life for tenants.

How Recession Proof Blueprint Can Help

Section 8 and other HUD programs provide an essential resource for millions of American households. Becoming a Section 8 property owner not only helps increase availability of affordable housing for individuals and families, but it’s also a lucrative investment opportunity with a guaranteed monthly check from the U.S. government.

Whether you're an experienced Section 8 investor or you’re testing the waters, Recession Proof Blueprint can provide valuable insights, help you make informed decisions, and guide you through the process step by step, maximizing your returns in the Section 8 housing market.

Schedule a strategy session today.